The YNAB Blog

-

How YNAB Makes Profit First Easier: My Simple Deposit Allocation Workflow

I love the Profit First methodology to help small businesses be more profitable. I first read the book Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine, by Mike Michaelowicz in 2015 and shortly thereafter started using it for my organizing business. It revolutionized how I think about my business’s money—and a…

-

Credit Card Fraud Is Inevitable—But YNAB Can Help

Credit card fraud is, unfortunately, a fact of modern life—even for the most careful among us. But with the right tools and habits, you can catch fraudulent charges early and make recovery so much easier. YNAB (You Need A Budget) is my secret weapon for staying on top of my finances and turning a stressful…

-

Give the gift of YNAB

As a professional organizer, I’ve been blogging for years about giving clutter-free gifts. People have a hard time letting go of gifts, even those they don’t love or use. And then they end up with too much stuff. So I always suggest giving experiences or donations or other non-tangible gifts instead. Here’s a great clutter-free…

-

Eleven reasons I’m grateful for YNAB

I wrote this post two years ago around Thanksgiving. Here’s a lightly edited version of that post. I added an 11th item–how YNAB helped us navigate a life-changing move. I’m being completely honest when I say I’m not sure where I’d be without YNAB! It’s the season to express gratitude and I am so very…

-

Is YNAB worth $109 a year?

Sometimes in social media groups I hear people grumble that YNAB is too expensive. To some, it feels counterintuitive to spend $109 a year (in the U.S., when paid annually) for an app that is supposed to help you spend less. A couple of years ago, I blogged about why YNAB is worth it for…

-

PSA: Open your mail!

I wrote this post for my organizing blog, but I realized it would be valuable for readers of this blog as well. Here’s a slightly edited version. Over the years, I’ve encountered many organizing clients who don’t open their postal mail. I get it. Mail can be scary. I remember back when I was dealing…

-

How to Categorize Big-Box Store Purchases in YNAB: Split Transactions Made Easy

Splitting transactions in YNAB can feel overwhelming, especially after a big shopping trip to Costco, Target, or Walmart. When one receipt includes groceries, household items, and personal care products, how do you categorize it accurately without spending an hour on your budget? Here’s a quick method that takes just minutes and keeps your YNAB reports…

-

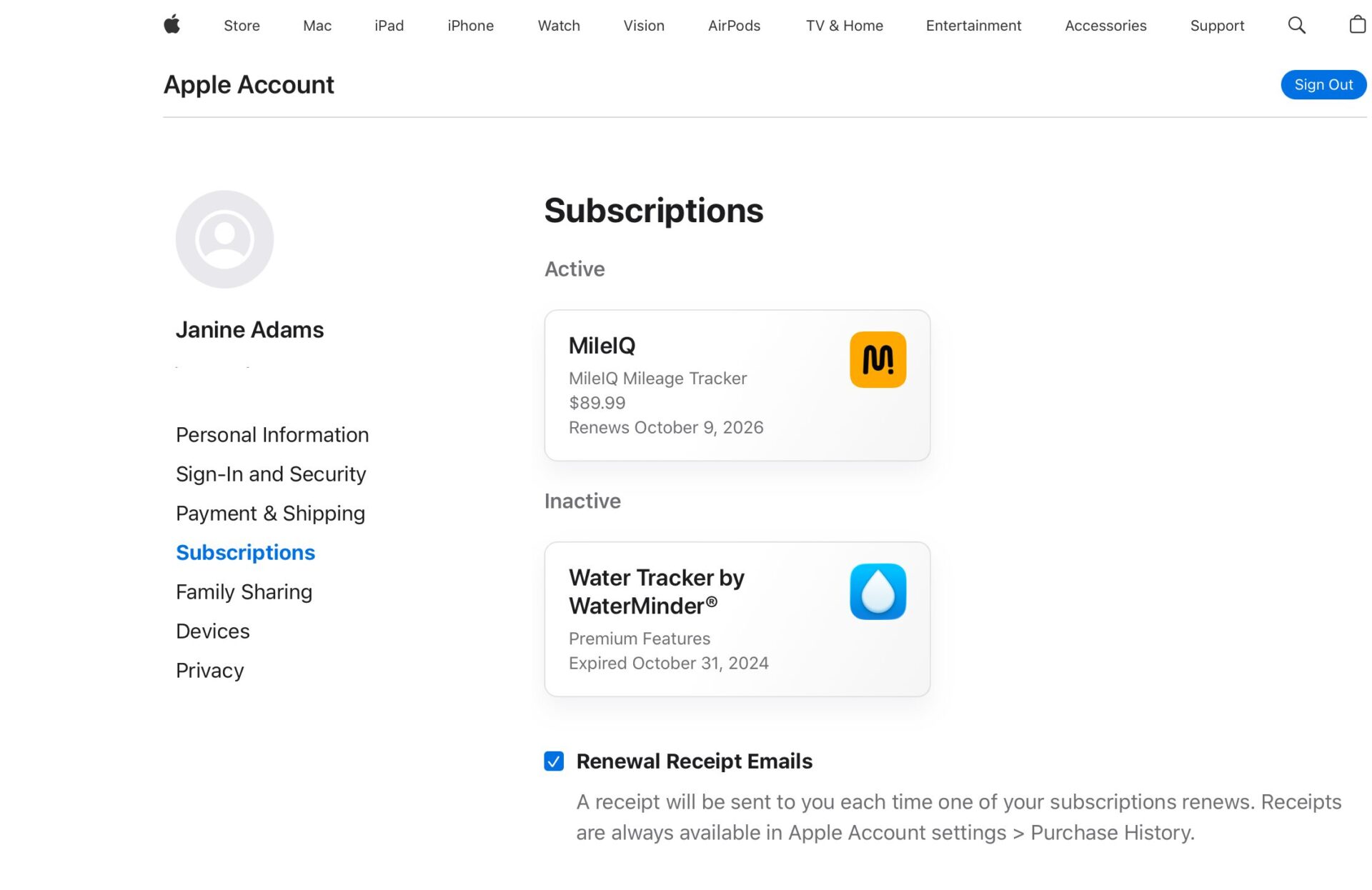

Tracking down mystery Apple charges

Apple subscriptions are ubiquitous and easy to forget. One great thing about YNAB is that it brings them to your attention. But it can be tricky to figure out what the charge is for. This morning, I had a mysterious $89.99 charge in my PayPal account from “Apple Services.” Here’s what I did to try…

-

How to Plan Holiday Spending: A Guide to Stress-Free December Finances

It’s never too early to start planning for the holidays. If you start now, your December self will thank you. September might feel early to think about holiday budgeting, but here’s the truth: the best time to prepare for holiday expenses is right now, when you’re not in the thick of the season’s chaos. If…

Are there any YNAB or spending topics you’d like me to write about?