The YNAB Blog

-

The Five Questions

Late last year, the YNAB method changed. Instead of four rules, we now have just one, Give Every Dollar A Job. And we now have five questions to support that rule. I blogged about this in December after the announcement came out. When I first heard about this shift, I was thrilled. And now, four…

-

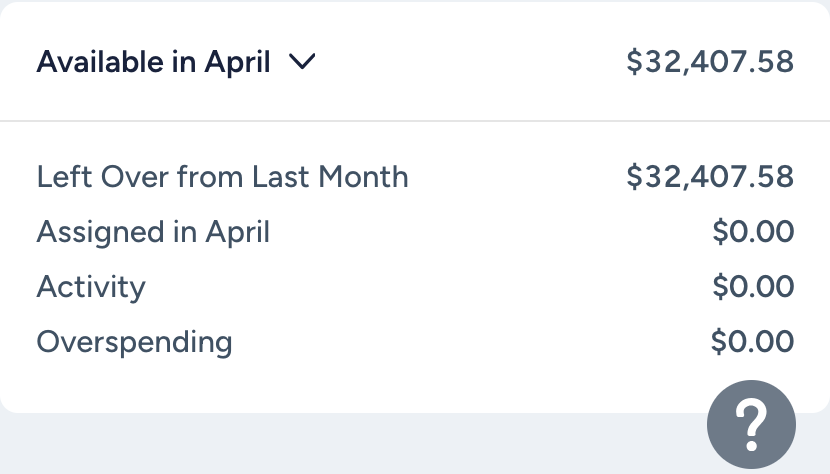

Keep an eye on last month

I’m writing this on April 2. When I did my daily YNAB check-in this morning, I saw that some transactions dated March 31 had imported overnight, which created some overspending on my March budget. This is why it’s so important in a new YNAB month to go back to the prior month budget screen at…

-

Handling Venmo in YNAB

There’s a reason why Venmo is so popular. It’s a simple and convenient way to pay someone. If you use both Venmo and YNAB here are some things to keep in mind: YNAB considers Venmo a bank, so if you add it to YNAB, it will show up in the Cash area of your Accounts…

-

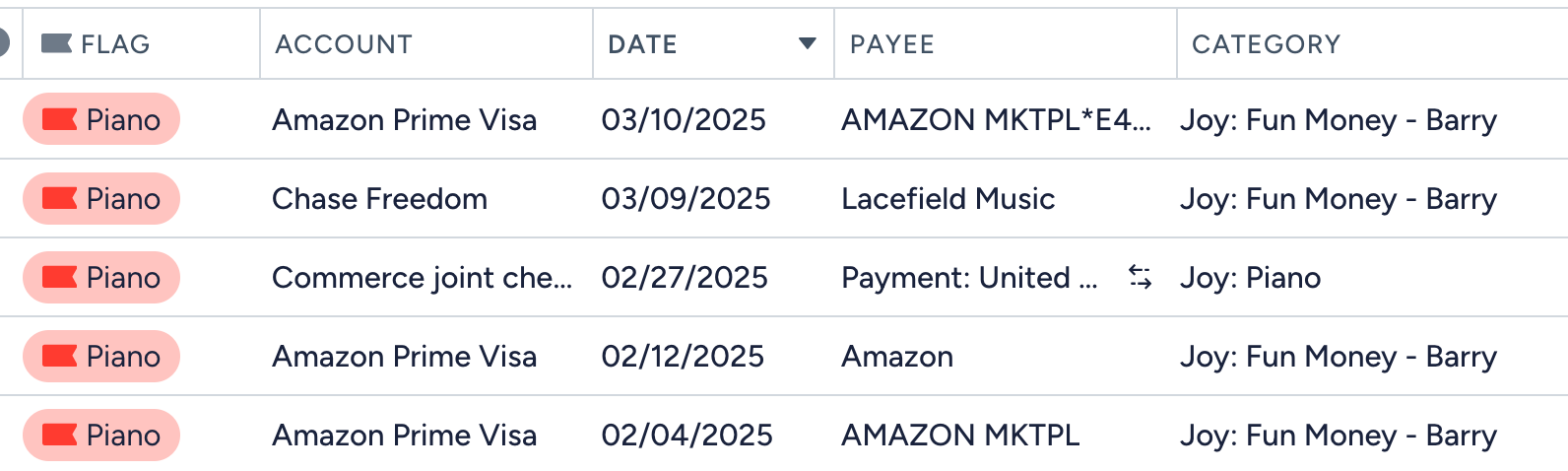

Tracking hobby spending

Sometimes I think the most fun part of starting a new hobby is acquiring all the things you need to do the hobby. At least that was the case for me when I started knitting 20 years ago. Or coloring ten years ago, which morphed into hand lettering seven years ago and became Bullet Journaling…

-

Treat your credit card like a debit card

One of the genius things about YNAB is the way it handles credit cards. Let’s say you spend $50 on food at the grocery store. In the credit card account, you categorize that $50 into the groceries category. Assuming you have the money in your groceries category, YNAB will move $50 from your groceries category…

-

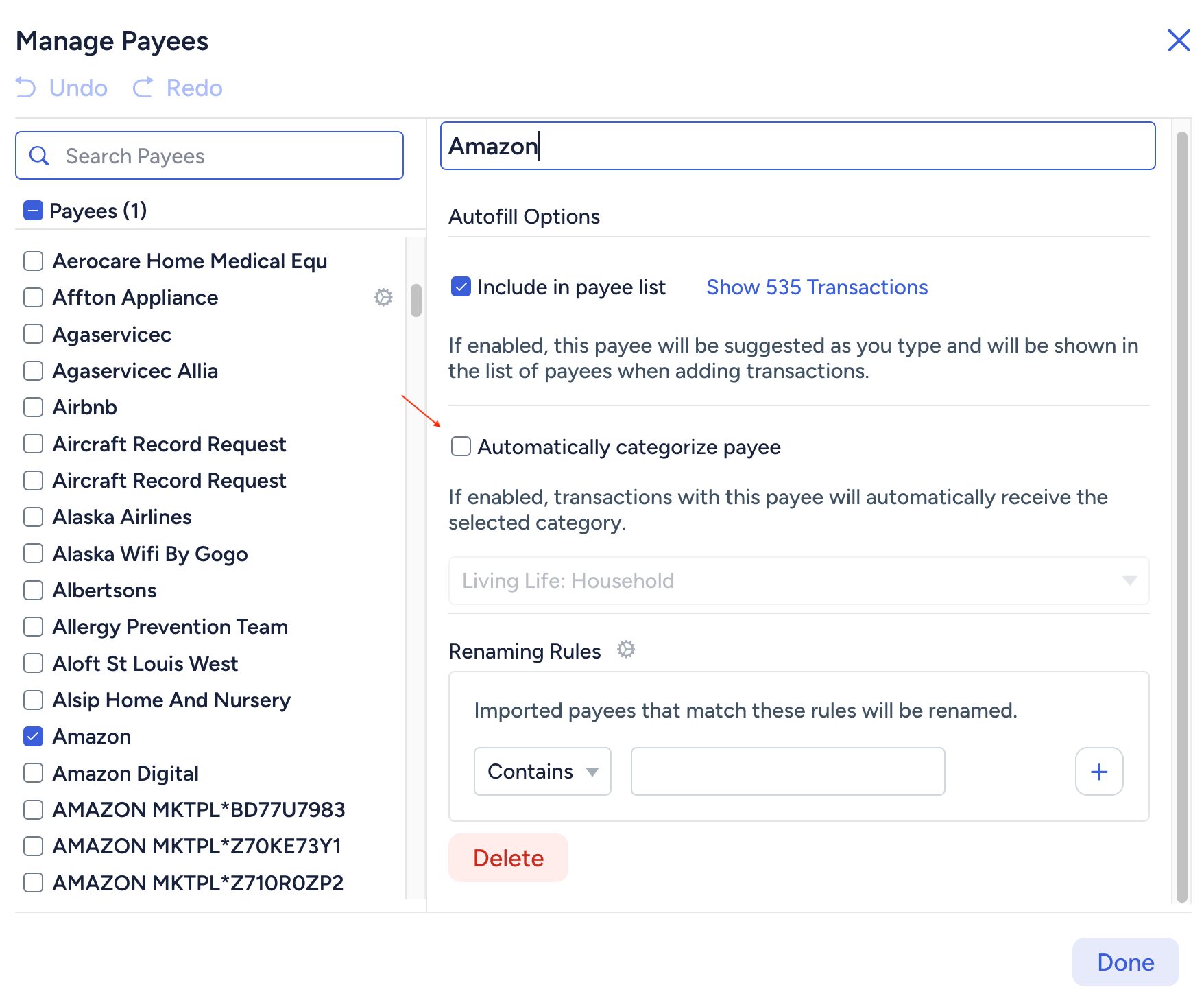

Be careful when approving transactions

Once you’ve been using YNAB for a little while (if you use direct import), YNAB might suggest a category for each transaction. It’s basing the suggestion on past transactions from the same payee. I want to urge you to take a moment to consider YNAB’s suggestion before clicking Approve. If you approve blindly, you may…

-

Can you trust your budget?

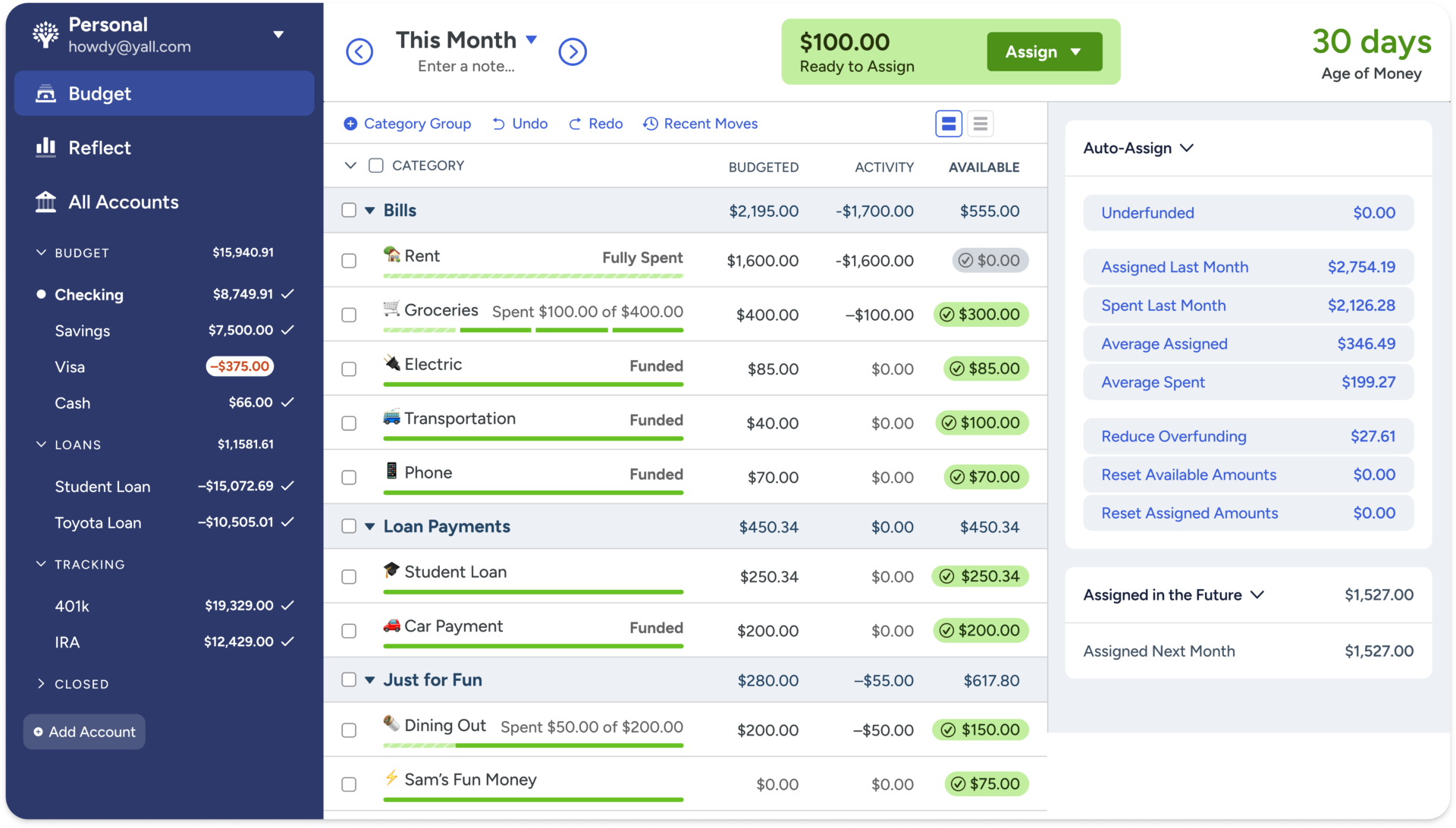

Trusting that your spending plan is accurate is the key to creating peace of mind with your finances. Luckily, YNAB makes it easy. All you need to do is a YNAB check up (which used to be known as a budget audit). I suggest doing it on the first day of each month. Here’s how:…

-

What does it mean to be a month ahead?

YNAB has long espoused the benefits of aging your money and getting a month ahead in your budget. With the recent revamp of the YNAB method, the Resilience question, “What can I set aside for next month’s spending?” replaced Rule 4: Age Your Money. The message and goal are unchanged: You want to break the…

-

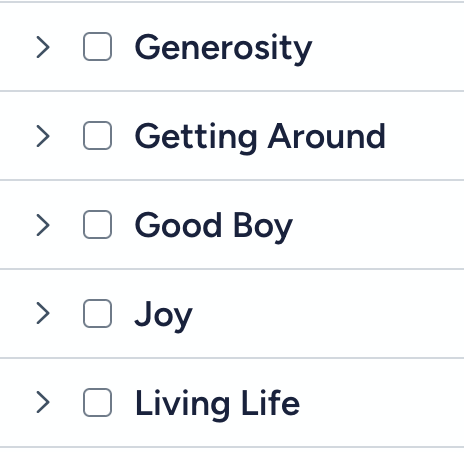

Creating a values-based template

On New Year’s Day, I revamped my category groups. I was inspired by Nick True’s excellent 2025 Getting Started Guide YouTube video, which mentioned having the option of having a values-based template for your spending plan. That really appealed to me, so thought I’d give it a try. I started by doing a Fresh Start,…

Are there any YNAB or spending topics you’d like me to write about?