Category: YNAB Basics

-

How to get back on track with YNAB (without doing a Fresh Start)

If it’s been a few weeks since you categorized and approved transactions in YNAB, it might feel overwhelming to catch up. You technically don’t have to catch up. You could start over with a Fresh Start, but your transaction history would be archived. The Fresh Start can be a great thing to do if you’re…

-

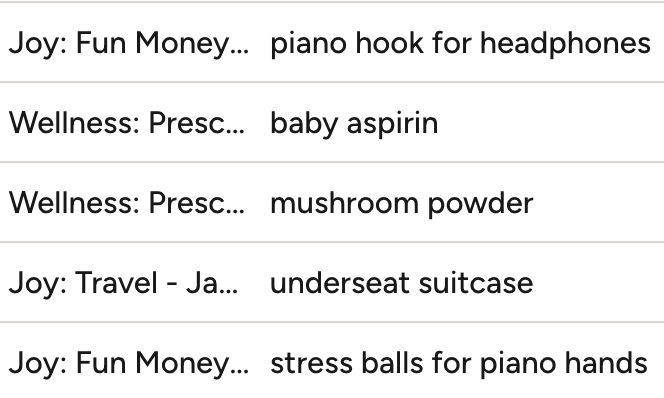

Use that memo field!

When you’re in the flow of approving transactions, it can be easy to not take the time to make a note in the memo field about that transaction. But in my opinion, it’s worth the time. Many transactions don’t merit a memo. The monthly electric bill, for example, might be completely obvious. But for most…

-

The Five Questions

Late last year, the YNAB method changed. Instead of four rules, we now have just one, Give Every Dollar A Job. And we now have five questions to support that rule. I blogged about this in December after the announcement came out. When I first heard about this shift, I was thrilled. And now, four…

-

Keep an eye on last month

I’m writing this on April 2. When I did my daily YNAB check-in this morning, I saw that some transactions dated March 31 had imported overnight, which created some overspending on my March budget. This is why it’s so important in a new YNAB month to go back to the prior month budget screen at…

-

What does it mean to be a month ahead?

YNAB has long espoused the benefits of aging your money and getting a month ahead in your budget. With the recent revamp of the YNAB method, the Resilience question, “What can I set aside for next month’s spending?” replaced Rule 4: Age Your Money. The message and goal are unchanged: You want to break the…

-

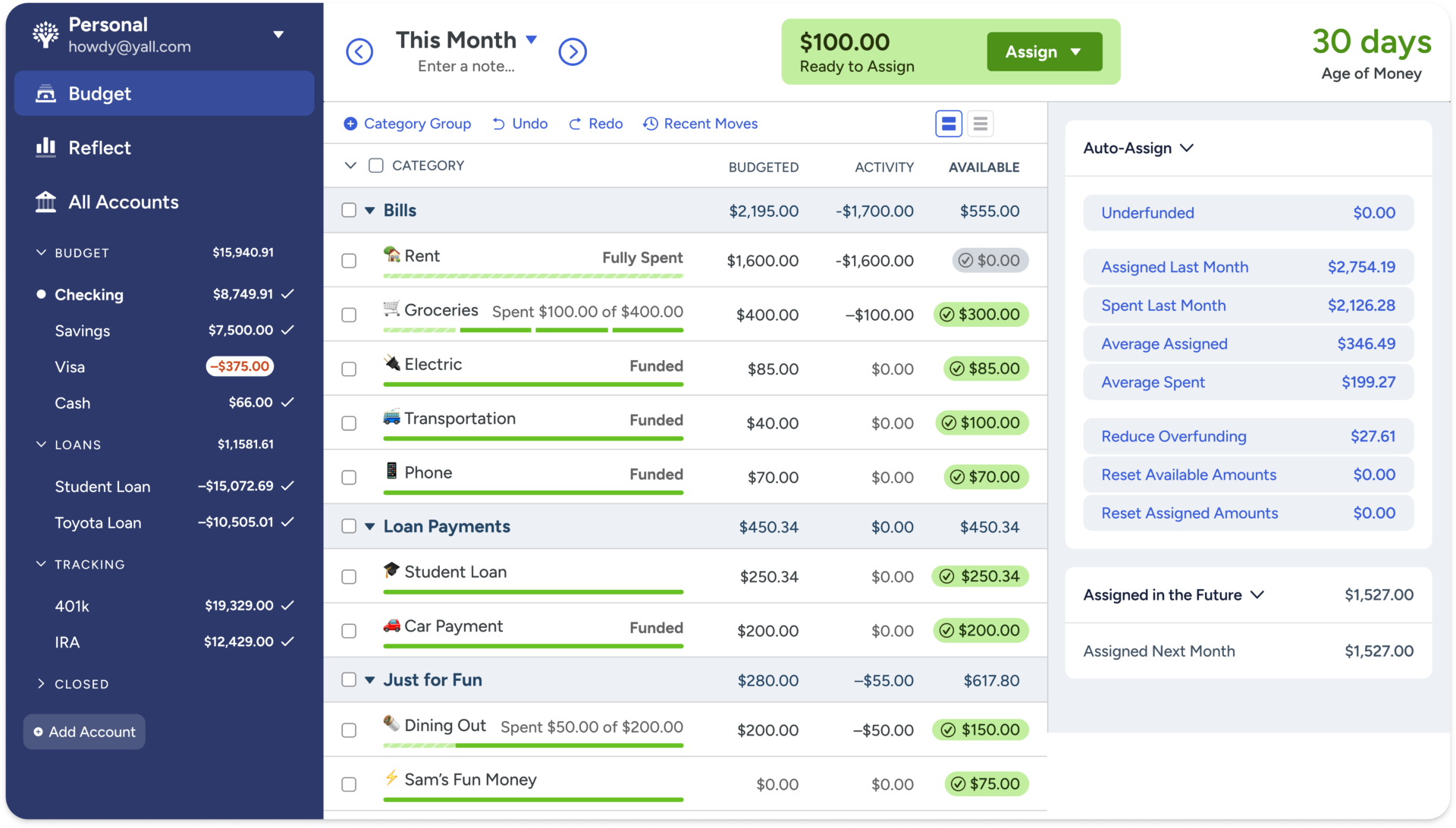

Creating a values-based template

On New Year’s Day, I revamped my category groups. I was inspired by Nick True’s excellent 2025 Getting Started Guide YouTube video, which mentioned having the option of having a values-based template for your spending plan. That really appealed to me, so thought I’d give it a try. I started by doing a Fresh Start,…

-

The dreaded red Ready to Assign

It is startling to open your budget and see a negative Ready to Assign (RTA) at the top of the screen. Instead of the soothing grey or the buoyant green RTA you probably expect, the red one is like an ugly alarm. And this is the time of the month that it usually happens, because…

-

My favorite day of the month

Tomorrow is June 1st. Ever since I got a month ahead in YNAB, the first day of the month has become my favorite. Here’s why. Once I’ve entirely funded a month, I choose to assign additional funds that come in to a category called Future Months. The alternative would be to flip ahead to a…

-

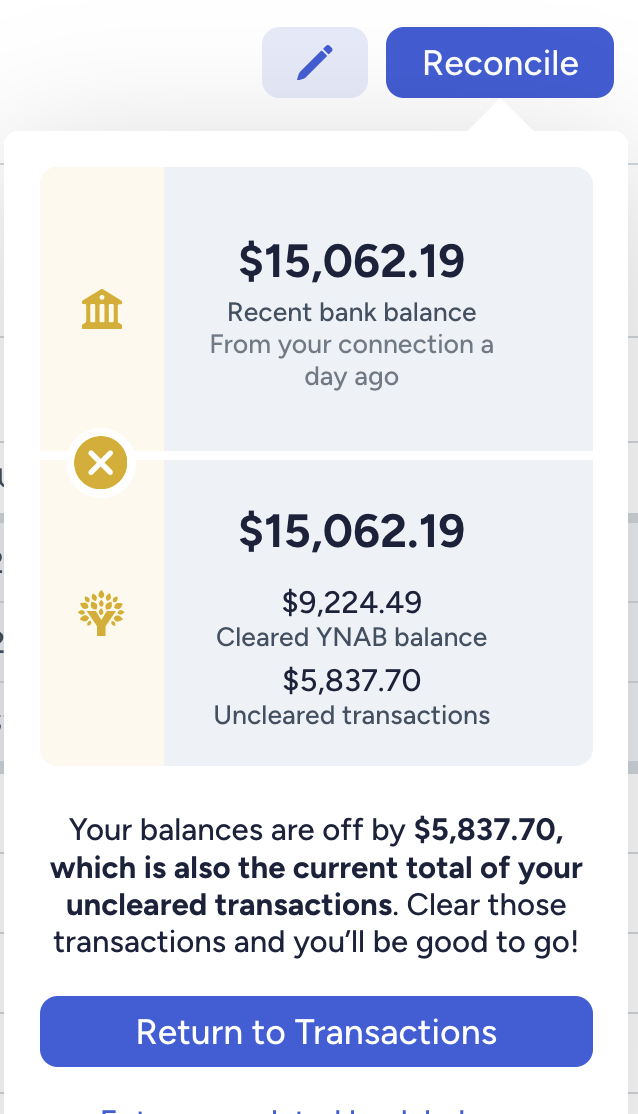

Why it’s important to reconcile (and how to do it)

Once you’re in the YNAB groove, you stop looking at your bank balance and instead consult your budget when you’re deciding whether to spend money on something. Because you’re putting away money for True Expenses, your bank balance swells. But all that money is accounted for. (It’s what’s known as being YNAB Broke.) So you…