It took me a few years to get so comfortable with YNAB it didn’t spark a little stress or overwhelm. Now, seven years into my YNAB journey I experience no stress with it and in fact really enjoy my daily YNAB routine. I actually check my budget several times a day but the morning check-in is where I always do the things I describe below.

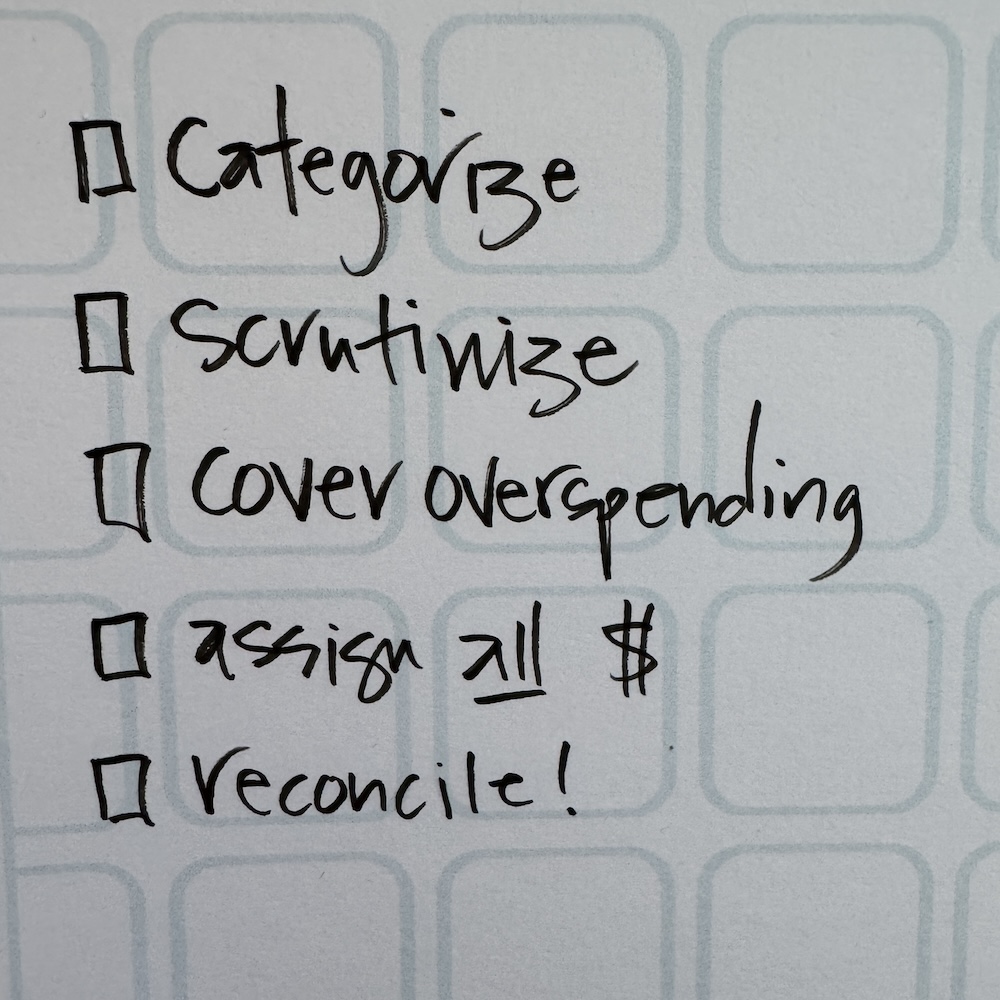

I want you to have a stress-free YNAB experience too. Here are my top five suggestions for YNABers who want to eliminate YNAB-related stress.

- Categorize and approve transactions every day. Doing this daily means a backlog shouldn’t build up, so you don’t get overwhelmed.

- Scrutinize each transaction before approving. YNAB might suggest a category for a transaction based on the payee, but it may not be right. Don’t automatically click approve. Rather make sure you really do approve of the category.

- Cover any overspending immediately. This gets easier as you build up more of a buffer, but if you can, don’t let those yellow or red bubbles languish. If you cover them on the spot (when the overspending happens) you avoid the craziness that can happen in YNAB when the month rolls over. To cover overspending, move money from a funded category (or Ready to Assign if there’s money available there) to the overspent category.

- Assign all your money. YNAB is based on the core principle of “Give Every Dollar a Job.” It can feel comforting at the beginning to leave money in RTA as a security blanket. But don’t do it. Assigned money is very safe in your spending plan. (You can always move it around.) Giving every dollar a job is the foundation of the YNAB method.

- Reconcile every time you’re in your accounts. After you categorize and approve, just click the Reconcile button. If you’re doing this every day, chances are very good you’ll be able to click “Looks Good” and move on. But if instead you’re asked whether or not the balance is accurate, go to your bank or credit card and check the balance. If it matches, click Yes. If there’s a discrepancy, click away from the Yes/No question, find the discrepancy and fix it. Then reconcile. Do it right then, in that session, if you can. The longer you wait, the harder reconciling becomes. Just doing a reconciliation balance adjustment can be tempting, but my advice is to avoid them, especially if the discrepancy is more than ten or twenty dollars. Finding and fixing then problem makes your spending plan and reports more accurate.

I practice what I preach and I truly enjoy staying on top of my finances and spending with YNAB. Once I figured these things out everything became easier. I urge you to incorporate these practices into your YNABing!

Leave a Reply